Friday,October 29, 2021 / 10:55 AM / by FBNQuest Research / Header Image Credit: iStock

PenCom's latest monthlyreport tells us that the assets under management (AUM) of the regulated pensionindustry increased by 13.7% y/y to NGN12.90trn (USD31.1bn) at end-August and by0.9% m/m. FGN debt securities accounted for 64.3% of the total. Once we addcorporate and state government paper, we find fixed-income exposure equivalentto 72.4% of the industrs AUM at end-August. This is a highly skewedallocation of assets in any universe, for which some explanations arewarranted.

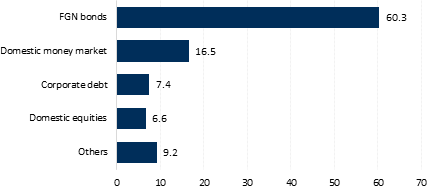

The share of domestic equities rose from 4.8% to6.6% of AUM over the twelve months, and members' holdings by 55% to NGN847bn.Over the same period the all-share index (ASI) at the NSE also rose by 55%,indicating little, if any shift by the PFAs into domestic equities. Those whoare not fresh arrivals in the market will remember well the beating the PFAstook from the stock market crash of 2008/09.

The ASI moved into positive territory ytd at thestart of this month but the gain of 4.2% in almost ten months is unexciting.There is no narrative of good growth and consumer spending to interest theinvestor. However, a handful of listed companies, banks above all, do paygenerous dividends.

The holdings of FGN paper are mostly the bonds,which represented 60.3% of total AUM at end-August. Investors have witnessed asharp widening of yields following the anomalous Q4 '20. The driver has surelybeen the huge deficit financing requirement of NGN5.60trn in the 2021 budget(before the passage of the supplementary by the National Assembly).

The proposed 2022 budget offers little respite,projecting a deficit of NGN6.26trn. This compares with NGN6.45trn for this yearincluding the supplementary and sets NGN2.51trn as the domestic borrowingtarget.

The PFAs are the core players at the monthlyauctions by the Debt Management Office (DMO). They hold 58.7% of the entirestock of the bonds (NGN13.25trn at end-June).

The average value of a retirement savings account(RSA) at end-August was NGN1.08m, unchanged from the previous month.

Just NGN184m was invested at end-August in thenewest RSA fund (no V), which has been created for micro pensions for theself-employed and SMEs. It has been in operation since January '20. Theremay well be a case for a new marketing initiative to tap this hugemarket.

AUM of PFAs, Jul 21 (%shares)

Sources: National Pension Commission (PenCom);FBNQuest Capital Research

Related News

- PFA Portfolio Analysis in August 2021: Net Asset Value Grew by 0.9% MoM

- Four Reasons Why PAL Pensions Should Be Your Preferred Pension Fund Administrator

- Nigeria's Pension Industry Asset Under Management Increased by 13% YoY to N12.78trn in July 2021

- American Hartford Gold Group Resource: Finding A Gold IRA Company and Its Benefits

- How Micro-Pension Can be Used to Deepen Financial Inclusion in Nigeria

- April 2021 PFI Portfolio Report: Net Asset Value Records First Rise in 2021

- PENCOM Revises Minimum Share Capital Requirement for Licensed PFA from N1bn to N5bn

- Nigeria's Pension Industry Asset Under Management Increased by 16.6% YoY to N12.25trn in Feb 2021

- Nigeria's Pension Industry Asset Under Management Increased by 17.9% YoY to N12.30trn in Jan 2021

- Pensions Industry Asset Under Management Increased by 20.3% YoY to N12.29trn in December 2020

- 5 Things to Note Before You Switch from One PFA To Another

Lagos, NG • GMT +1

Lagos, NG • GMT +1

2403 views

2403 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us