Wednesday, February 24, 2021 /05:00 AM / By Proshare Research/ Header Image Credit: EcoGraphics

The Eurobond

The price and yield movement of a Eurobond instrument is largely impacted by the health of the issuing country, for the case of Nigeria the FGN Eurobond instrument is considered a risky instrument as the economy is highly dependent on earnings from Oil which is impacted by the global and not controlled by Nigeria. Therefore, the movement in price and yield of the FGN Eurobond was majorly driven by movement in oil price and most recently the COVID-19 pandemic.

Also, news of the US stimulus package and a coronavirus vaccine boosted investor confidence as yields declined and bond price rose towards the end of the year (Prices move inversely with yields).

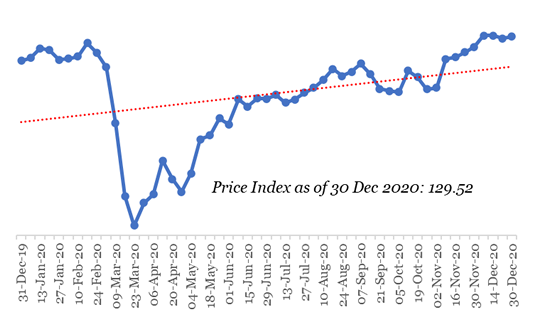

The price index movement of the FGN Eurobond represented a ?óÔé¼?£bullish flag?óÔé¼Ôäó or what shaped up to be a generally rising slope for 2020, at the peak of the pandemic the price index fell as low as 77.61, however, with the gradual reopening of global economies and a restored hope in economic recoveries across countries, the price index picked up a step or two and at the end of the year the index pirouetted higher than the pre-COVID-19 period, the price index rose YTD by +4.79% as of 30th December 2020 (see chart 5 below).

Chart 1: FGN Eurobond YTD Price Index for 6.75% US$500m Jan 2020

Source: Cbonds, Proshare Research

Do feel free to share your opinions/observations and feedback with us vide [email protected] and/or [email protected]

Watch Video

Downloadable PDF - The 2020 Nigerian Capital Market Report

1. Complete Report: The Nigerian Capital Market Report 2020: Leveraging a Crisis - Jan 28, 2021

2. Executive Summary: The Nigerian Capital Market Report 2020: Leveraging a Crisis - Jan 28, 2021

Related Links

1. NCM 2020:Technology and the Nigerian Capital Market

2. NCM 2020:Regulatory Governance in 2020

3. NCM2020: Energy Commodities Took a Big Hit in 2020

4. NCM 2020: Bond FundsGrew By 443.80% YoY in 2020

5. NCM2020: Lower FX Earnings Widened the Gap Between Two Markets

6. NCM2020: FGN Eurobond Was Driven by Movement in Oil Prices and COVID-19 Pandemic

7. NCM 2020: TreasuryBills Fell to a Record Lows in 2020

8. NCM2020: Yields in the Fixed Income Market Took a Downward Trajectory in 2020

9. NCM2020: Top Ten Moments in the Nigerian Capital Market in 2020

10. NCM 2020: NASD USIClosed Green in 8 Out of 12 Months in 2020

11. NCM2020: Extracts of Financials of Quoted companies - DANGCEM Tops on Revenue andPAT

12. NCM2020: Agriculture Sector - OKOMUOIL Tops on EPS and PAT Margin

13. NCM 2020: HealthcareSector - NEIMETH Tops on ROE and PAT Margin

14. NCM2020: Industrial Goods Sector - DANGCEM Tops on EPS as BUACEMENT Tops on PERatio

15. NCM2020: Oil and Gas Sector - TOTAL Tops on PE Ratio as JAPAULOIL Tops on PATMargin

16. NCM2020: Consumer Goods Sector - NESTLE Tops on EPS as DANGSUGAR Tops on PAT Margin

17. NCM 2020: FinancialServices Sector - NESF and STANBIC Top on EPS

18. NCM2020: Sectoral Market Capitalisations: Oil and Gas Records - 20.62% Decline in2020

19. NCM2020: A Review of Gote and Toni Indices in 2020

20. NCM 2020: NSE Records1 New Listing to 5 Delistings in 2020

21. NCM2020: Growth of Securities Listed on NSE - Total Securities Listed Increased by0.55%

22. NCM2020: 23% of Listed Companies on NSE on Pause in 2020

23. NCM 2020: 84 StocksAre Off 52-Week Highs as 85 Near 52-Week Lows

24. NCM2020: Forty-one Financial Services Stocks Are Penny Stocks in 2020

25. NCM2020: NSEASI Performance Review and How Each Company Fared in 2020

26. NCM 2020: MarketRecords 57 Gainers to 66 Losers in 2020

27. NCM 2020: ForeignPortfolio Participation in Equity Trading Dropped from March to November 2020

28. NCM2020: Trading Statistics in 2020 - Market Volume Increased by 21.69%

29. NCM2020: NSE Market CAP Closed at US$55bn Below the Peak of US$84bn Recorded in2013

30. NCM2020: NSEASI Closed Green in 9 Out of 12 Months in 2020

31. NCM2020: Markets Were Volatile Globally in Year 2020 as COVID-19 Pandemic InducedUncertainty

32. The NigerianCapital Market Report 2020: Leveraging a Crisis

Monthly NCM

1. The November 2020 Nigerian Capital Market Service Report - Proshare

2. The October 2020 Nigerian Capital Market Service Report - Proshare

3. The September 2020 Nigerian Capital Market Service Report - Proshare

4. The August 2020 Nigerian Capital Market Service Report - Proshare

5. The July 2020 Nigerian Capital Market Service Report - Proshare

6. The June 2020 Nigerian Capital Market Service Report - Proshare

7. The May 2020 Nigerian Capital Market Service Report - Proshare

8. The April 2020 Nigerian Capital Market Service Report - Proshare

9. The March 2020 Nigerian Capital Market Service Report - Proshare

10. The February 2020 Nigerian Capital Market Service Report - Proshare

11. The January 2020 Nigerian Capital Market Service Report - Proshare

12. The November 2019 Nigerian Capital Market Service Report - Proshare

13. The October 2019 Nigerian Capital Market Service Report - Proshare

14. The September 2019 Nigerian Capital Market Service Report - Proshare

15. The August 2019 Nigerian Capital Market Service Report - Proshare

16. The July 2019 Nigerian Capital Market Service Report - Proshare

17. The June 2019 Nigerian Capital Market Service Report - Proshare

18. The May 2019 Nigerian Capital Market Service Report - Proshare

19. The April 2019 Nigerian Capital Market Service Report - Proshare

20. The March 2019 Nigerian Capital Market Service Report - Proshare

21. The February 2019 Nigerian Capital Market Service Report - Proshare

22. The January 2019 Nigerian Capital Market Service Report - Proshare

Annual Reviews & Outlooks

1. NCM2020 - Fin. MKT in Transition: Understanding Past Uncertainties; Preparing for New Possibilities

2. Surviving Uncertain Times in the Nigerian Financial Market

Special Reports & Publications

1. NSE Ten Years After a Takeover: The Good, The Bad and Undecided

2. NSE Post Takeover: A Journey Through Time

3. NSE Post Takeover: The Story of Then and How

4. NSE Post Takeover: Market as a Metaphor

5. NSE Post Takeover: The Imperatives of Tomorrow: Myths, Risks and Opportunities

6. NSE Post Takeover: Power Moves -Demutualization and The New Board Games

7. NSE Post Takeover: A Whole New World-Reimagining Endless Possibilities

8. NSE Post Takeover: Back of the Envelope

Online Trading Reports

1. Online Trading Ranking Report 2020 - Trading in a Period of a Virus; Building Good Habits

2. Online Trading Ranking Report 2019 - Refining The User Experience; Trends In Digital Trading

3. Nigerian Online Trading Portals Ranking Report 2018

4. Nigerian Capital Market and FX Online Trading Portals Ranking Report H2 2017

5. The Nigerian Capital Market Online Trading Portals Ranking Report

6. The Nigerian Online Trading Report

CMO Reports

1. Nigerian Equity Market Outlook: COVID Out, Riots In?

2. Nigerian Economic and Financial Markets: H1:2020 Review and H2:2020 Outlook Opportunity in a Crisis?

3. Nigeria Economic Outlook 2021: A Shot at Recovery

4. 2021 Outlook - Is The Tunnel Getting Darker or Brighter

5. Nigeria in 2021: Positioning in the New Normal

6. Nigeria 2021 Outlook - Navigating Unsteady Terrain

7. Nigeria FY 2021 Macroeconomic Outlook - A Break in the Clouds

8. Nigeria 2021 Outlook: COVID-19 Recession and the Long Road to Economic Recovery

Selected Articles

1. The Year 2020 in Retrospect: A Bleak Year for Households

2. Will Gold Prices Rally in 2021? Here are Its Ebbs and Flows

3. Review of 2020 Activities In The Islamic Finance Market And The Outlook For 2021

4. Ranking Global Equity Markets in 2020: NASDAQ Takes The Lead

5. Holiday Blues Dampen Trading Activities for Last Trading Session

6. 2021:President Buhari Reaffirms Commitment To A United And Progressive Nigeria

7. Ten Most Capitalised Stocks Account for 83% Contribution to the NSEASI

8. Proshare's New Year Message - Change, Technology, and The New Corporate Calling

News Posts Referenced in the Report

1. NSE Revolutionises Public Offerings Subscription with Electronic Platform

2. Finally, NSE Launches the Growth Board with FintechNGR as a Strategic Partner

3. NSE Migrates Four Companies from ASeM to Growth Board

4. Demutualisation: NSE Announces Chief Executives for Emerging Entities

5. NSE Members Assent to Demutualisation Resolutions at COM and EGM

6. COVID-19: NSE Activates 30-day Remote Work Plan; Remote Trading to Continue

7. FGN 14 Day Restriction: NSE to Sustain Remote Trading Amidst COVID-19 Pandemic

8. CAC Issues Guidelines on Holding of AGMs of Public Companies Using Proxies

9. COVID-19 and AGM by Proxy: Lessons from GTBank Approach

10. Revision of Stamp Duty on NSE Transactions to 0.08% from 0.075% Effective 7th December 2020

11. HM Zainab Shamsuna Ahmed Urges IST to Discharge Duties Diligently

12. NSE to Re-Introduce Trading Fees for Securities Traded on the Fixed Income Market

Lagos, NG • GMT +1

Lagos, NG • GMT +1

1310 views

1310 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us