Monday, January 18, 2021 / 9:20 PM / by Cowrywise / Header Image Credit: Twitter; @cowrywise

10 Years of Mutual Fundsin Nigeria (2011-2020)

Within the past 10 years, the total value of mutualfunds in Nigeria grew by 1,927%! That's solid progress. In 2011, the totalvalue was N74 billion and that grewto N1.5 trillion in 2020. Thissimply means that more people are starting to invest in mutual funds, and wehave made this easier as the number 1 retailer of mutual funds. On Cowrywise,you access the highest variety of mutual funds anywhere in Nigeria.

Speaking of variety, investors now have 108 choices topick from. In 2011, that number sat at 43. What's more interesting? Cowrywiseoffers 18% of these mutual funds and we'll add more this year. You might bewondering how people get to choose which fund to go with when they have so manyoptions? For investors who use Cowrywise, they get to take a recommendationtest for free. Based on the results, we match them with the best-fit funds.

How Mutual Funds in 2020Performed

The star funds in terms of returns were equity andbond funds. As I stated earlier, 2020 was a year of oxymorons. When it becameevident that the money market was not going to break-up its relationship withlow returns, people moved towards equities and boom!

The boom was so strong that on the 12th of November,2020, Bloomberg released an article with this headline: "Nigerian Stocks SurgeMost Since 2015, Trigger Circuit Breaker". What does this mean? There was ashocking amount of trades in the stock exchange that day. So much that themarket had to take a break.

Based on this, we saw a rise in the returns of equitymutual funds. Remember, these are funds that invest in equities or stocks. Theyare managed by professionals who help select stocks to earn investors the bestpossible returns.

On the other hand, the consistent drop in treasurybills-a major component of money market funds-led to a drop in their returns.Imagine dropping from as high as 12% per annum to 1% per annum? You don't needto imagine because it actually happened.

However, there was a funny moment with treasury billslast year; when the rates turned negative. One would expect that this wouldhave chased investors away, but that didn't happen. Rather, people were willingto pay the government to borrow from them.

In all, investors on Cowrywise earned as high as 20%on their Naira and dollar investments. Let's see the top funds for eachcategory in 2020.

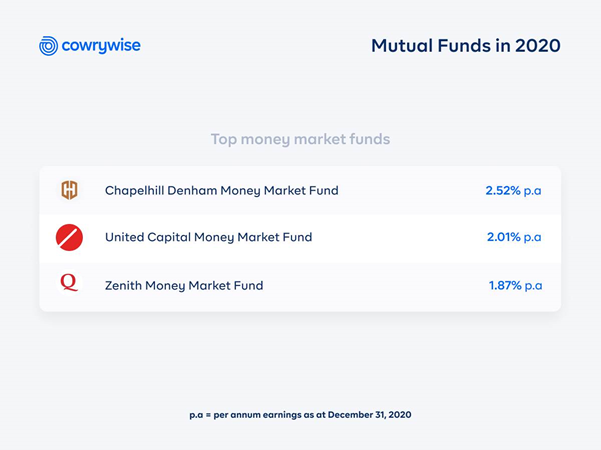

Top Money Market Funds

Money market funds are mutual funds that investprimarily in money market instruments like treasury bills. Based on assetsunder management, the money market funds which grew the most were:

- FSDH Treasury Bill Fund (93% growth)

- PACAM Money Market Fund (59% growth)

- Greenwich Plus Money Market Fund (40% growth)

Based on returns, these were the top 3 money marketfunds:

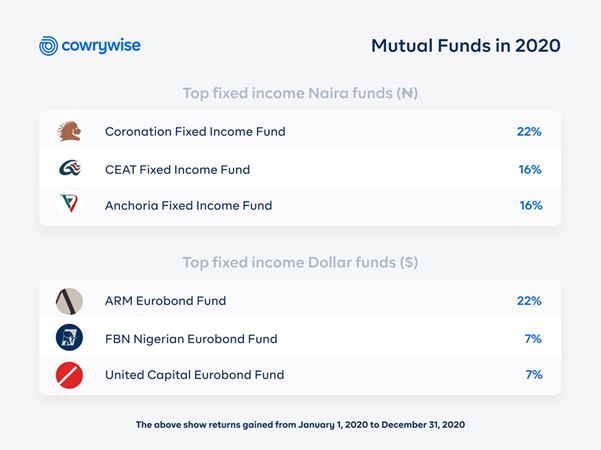

Top Fixed Income Funds

This type of mutual funds invest cash in fixed incomeinstruments. Bonds are the most common types of fixed income funds. In thiscategory, we have two sub categories-Naira fixed income funds and eurobonds(popularly referred to as dollar funds). Last year, the top 3 Naira bond funds,based on growth of assets, were:

United Fixed Income Fund (grew by 2,681%)

Zenith Fixed Income Fund (grew by 1,589%)

Stanbic IBTC Bond Fund (grew by 1,189%)

While for dollar funds, the fastest growing, based onassets, were:

United Capital Eurobond Fund (grew by 122%)

FBN Nigerian Eurobond Fund (grew by 73%)

Legacy USD Bond Fund (grew by 70%)

How did these funds perform? Check this:

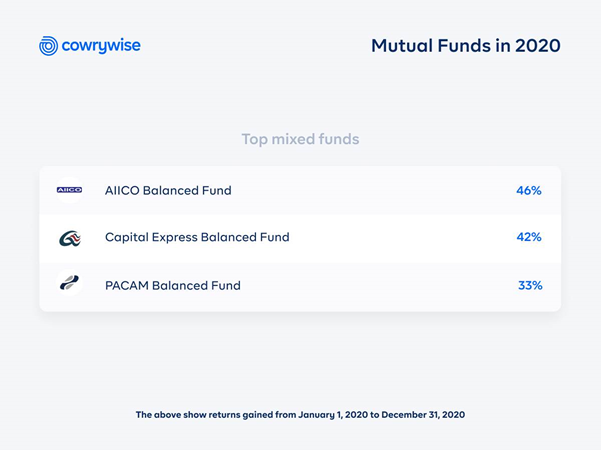

Top Mixed Funds

This is the salad of mutual funds. They usually investin a mix of bonds and equities. For 2020, the fastest growing mixed funds,based on assets, were:

- Coronation Balanced Fund (grew by 545%)

- AIICO Balanced Fund (grew by 58%)

- FBN Nigeria Balanced Fund (grew by 42%)

And they dished out beautiful returns. Check out thetop 3:

Top Equity Mutual Fundsin 2020

As stated earlier, the Nigerian stock market wascontrarian last year. When markets fell across the world, it picked up and inturn boosted the performances of equity mutual funds. Equity funds with thehighest growth in assets were:

- AXA Mansard Equity Income Fund (grew by 102%)

- Paramount Equity Fund (grew by 94%)

- United Capital Equity Fund (grew by 66%)

Investors with these funds had a good year. Here arethe top three funds based on earnings:

Top Ethical Funds

These funds invest in screened instruments. Forexample, there are ethical funds that do not invest in the stocks of gunmanufacturers. They present an ideal way for everyone to invest-includingMuslims. These three ethical funds were the fastest growing in 2020:

- Stanbic IBTC Imaan Fund (grew by 38%)

- ARM Ethical Fund (grew by 34%)

- Stanbic IBTC Ethical Fund (grew by 30%)

Their returns were quite decent. The top 3 based onreturns were:

What else happened in2020

- In August 2019, it cost N36,500 to invest $100 (excluding processing charges). By August 2020, it cost about N47,500 to invest the same $100-that is a 30% increase. Asides from returns, dollar investors on Cowrywise-who held their investments from August 2019 to August 2020-gained ~30% when their investments were converted back to Naira.

- We added 6 new funds to our growing list of mutual funds.

- Onions became the new gold, with prices growing by up to 285% between May and November.

Credits

* This post, Mutual Funds in 2020, was first published onCowrywise on Thursday, January 14, 2021.

Related News

- Coronation Research Releases Report Themed: From Savings to Mutual Funds

- Why You Should Use A Fund Manager in A Declining Fixed Income Yield Environment - FBNQuest

- FSDH Asset Management launches the FSDH Dollar Fund

- Afrinvest Launches Dollar Fund to Help Investors Diversify their Portfolio

- USD90bn of Central Bank Support Underscores Mutual Fund Systemic Risks

- NCM2020 (29) - Mutual Funds: From Equities to Fixed Income and Back

- Cordros Dollar Fund Opens for Subscription On Monday, November 25, 2019

- Cordros Asset Management Set To Launch a Dollar Mutual Fund

- KIPER 2019 and GIPS 2020: Communicating Performance In Pooled Funds

- Why Invest in FAAM Money Market Fund?

- A Comparative Analysis of Mutual Funds in Nigeria

- Mutual Funds And Investment Management - The Proxy Process

- NSE Partners With Market Stakeholders, Launches Mutual Funds Trading Platform

- Mutual Funds -A Tale of Mixed Fortunes

- Mutual Funds Can Create Wealth and Fund Critical Infrastructure - FSDH Research

- FBNQUEST Asset Management Records strong performance in Mutual Funds

- SIM Capital Alliance Value Fund Changes Name to ValuAlliance Value Fund

- Cordros Capital launches Milestone Funds 2023 and 2028 for Nigeria

- 4 Best-Performing Equity Mutual Funds in Q1 2018

- Mutual Fund Assets Cross The Half Trillion Mark

Lagos, NG • GMT +1

Lagos, NG • GMT +1

1472 views

1472 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us