Snapshot

1. EQUITIES MARKET

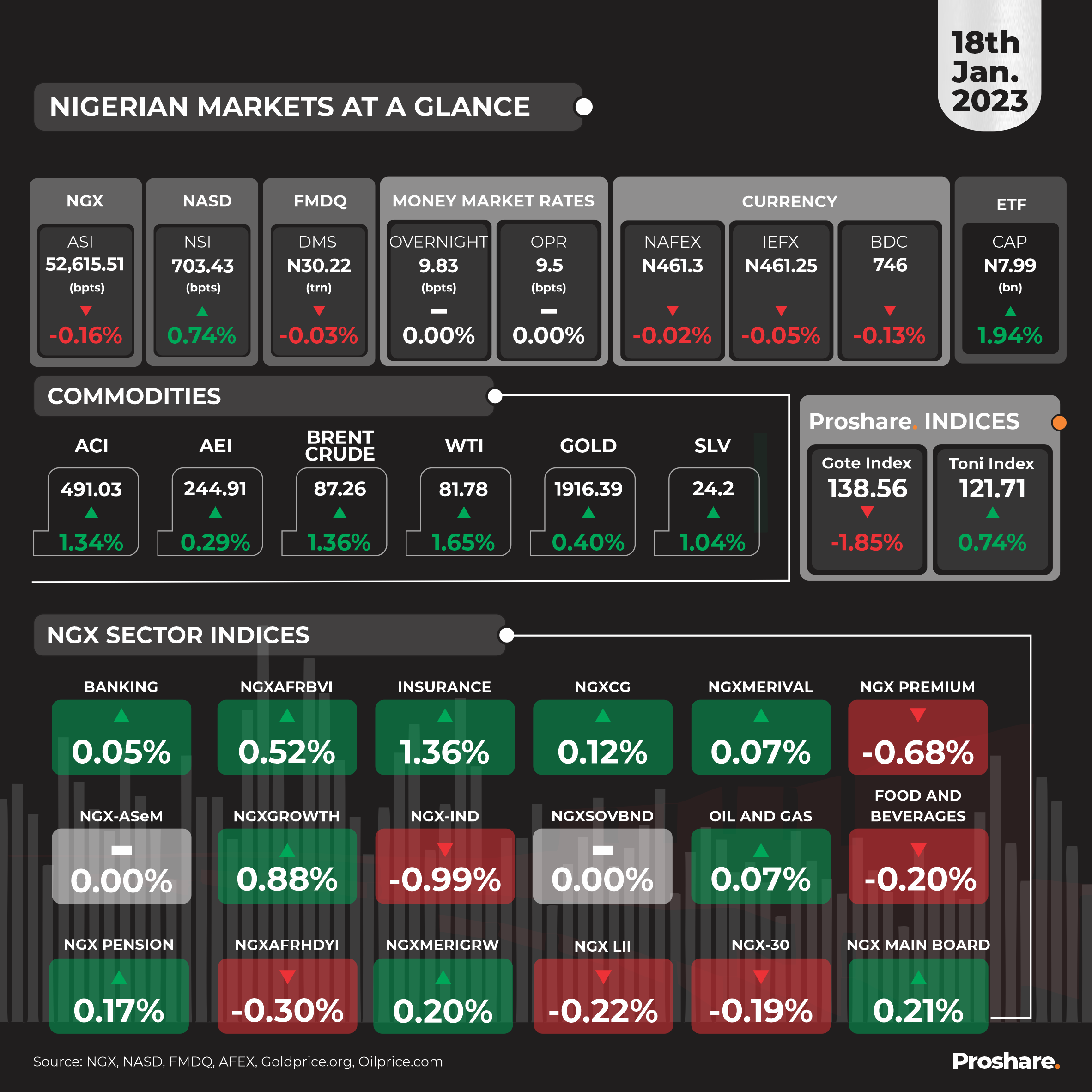

Nigerian Equities Market closed positive as the key market indicator declined by 85.80 bps amid positive market breadth

The NGX All-Share Index declined by -0.16% to close at 52,615.51 basis points as against a 0.67% loss recorded previously to close at 52,701.31 basis points at the end of the last trading session. In Naira terms, the NGX Market CAP records a N46.74bn loss.

YTD, the NGXASI Stands at +2.83%

The total volume traded advanced by 2.99% to close at N228.48m, valued at N4.44bn and traded in 3,681 deals. STERLINGBANK was the most traded stock by volume with 94.27m units traded while GEREGU was also the most traded stock by value which is put at N1.35bn

Sectoral performance was broadly positive as ten (10) NGX sector index closed northward, six (6) sector index closed southward and two (2) closed flat. The NGX INSURANCE index advanced by 1.36% to top the gainer’s chart while the NGX INDUSTRIAL index declined by 0.99% to top the losers’ chart.

The Gote index declined by -1.85% at 138.56 basis points while the Toni index advanced by 0.74% to close at 121.71 basis points.

At the close of trading, the market recorded 36 gainers to 12 losers and 49 unchanged. CHELLARAM topped the list of gainers while FTNCOCOA topped the list of losers.

Thus, market breadth closed negative as the Market Breadth Index (MBI) is put at -0.07x.

Volume and Value Contribution

STERLNBNK led the volume’s chart with 43.25% contribution and closely followed by ZENITHBANK and GTCO

GEREGU tops the value’s chart with 30.26% contribution and followed by AIRTELAFRICA and DANGCEM

NGX Earnings Summary

No Financial statement was released on the NGX Exchange today.

NGX Corporate News

No Corporate News was released on the NGX Exchange today

1.2 NASD OTC Exchange - Unlisted Equities

The NASD market index advanced by 0.74% to close at 703.43 basis points as against the 1.04% loss recorded previously to close at 698.23 basis points

The total volume traded declined by -49.21% to close at 85,356 units valued at N7.05m and traded in 10 deal(s).

At the close of trading, NASD OTC market recorded one (1) gainer(s) to one (1) loser(s)

NASD Earnings Summary

No Financial statement was released on the NASD OTC Exchange today.

NASD Corporate News

No Corporate News was released on the NASD OTC Exchange today.

1.3 Global Indices

On the global scene, the Japen Nikkel 225 Index leads the top five gainers with 2.50% gain while Mexico IPC tops the top five losers with 0.58% loss as of 4pm Nigerian Time

1.4 African Indices

Similarly, on the African scene, the Malawi Malawi ASI tops the top five gainers with 3.23% gain while the South Africa Financial 15 Index tops the top five losers with 1.13% loss as of 4pm Nigerian Time

2.1 Debt Market Size

The FMDQ Debt Market Size declined by 0.03% to close at 30.22.

2.2 Overnight and Open Repo (OPR)

The Overnight lending rate closed flat at 9.83% while the Open Repo (OPR) rate closed flat at 9.50%

3.1 AFEX Indices

The AFEX ACI advanced by 2.61% to close at 476.31 while the AFEX advanced by 0.29% to close at 244.56

3.2 AFEX Commodity Prices

Cashew advanced by 2.26% to top the gainers chart while Maize declined by 3.91% to top the losers’ chart.

3.3 Global Commodity Prices

Gold advanced by 0.40% while Silver advanced by 1.04% as of 11:53 NY time

In the energy market, Brent advanced by 1.36% and WTI also advanced by 1.65% as of 11:53 AM Central Daylight Time (CDT)

The naira at the I&E FX Window closed at N461.25/USD while the NAFEX rate closed at N461.3/USD

Lagos, NG • GMT +1

Lagos, NG • GMT +1

186 views

186 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us