Snapshot

1. EQUITIES MARKET

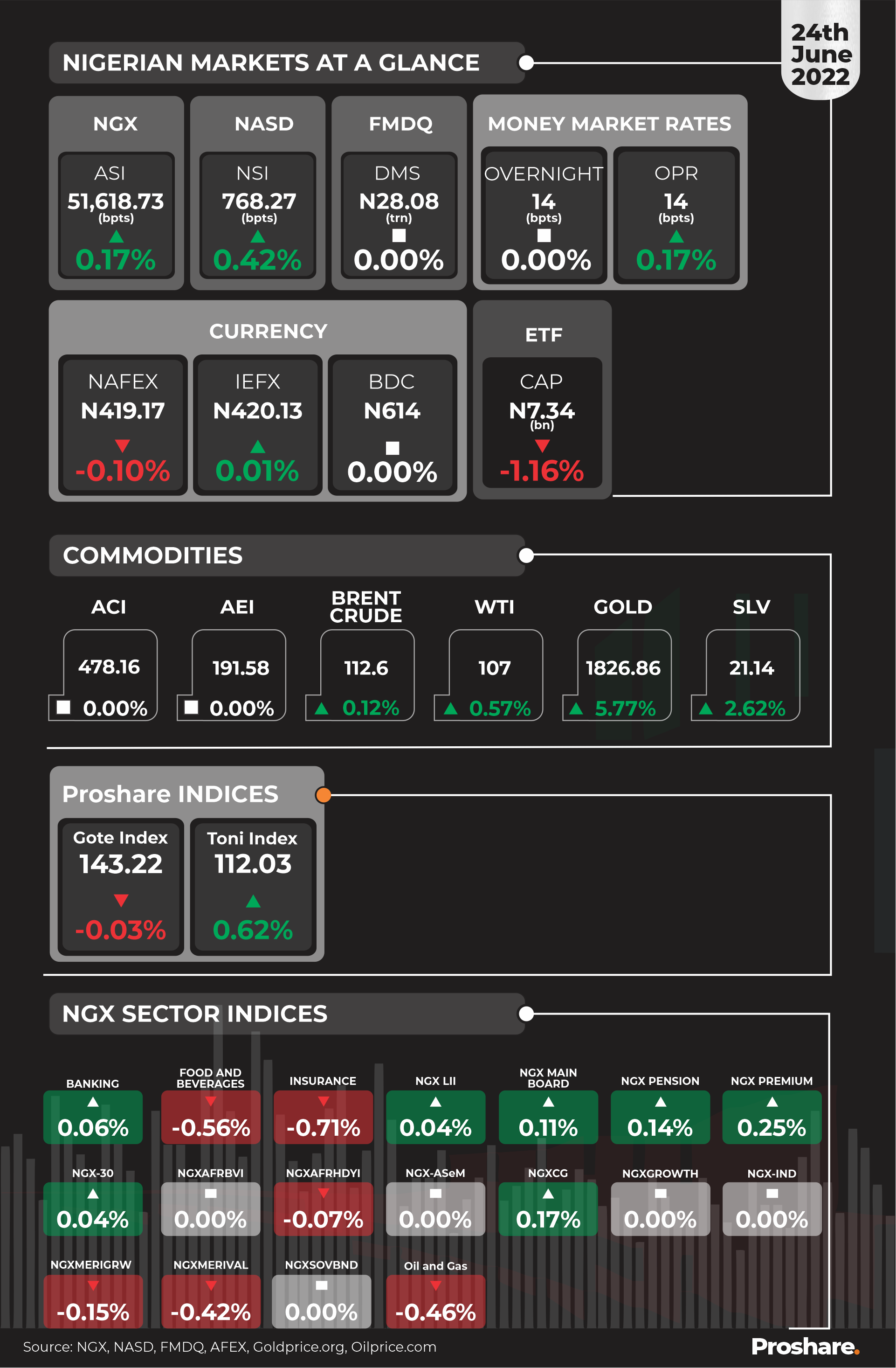

Nigerian Equities Market extends market gain as the bulls continue to dominate trading activities to close the week on a positive note.

The NGX All-Share index inched up by +0.17% to close at 51,705.61 basis points as against +0.47% gain recorded at the end of the previous trading session. In Naira terms, the NGX Market CAP records N46.83bn gain

YTD, the NGXASI Stands at +21.04%

The total volume traded declined by -30.08% to close at 156.09m, valued at N1.83bn and traded in 4,312 deals. OANDO was the most traded stock by volume with 19.32m units traded while MTNN was the most traded stock by value which is put at N239.09m.

Sectoral performance was broadly positive as seven (7) NGX sector index closed northward, six (6) closed southward while five (5) closed flat. The NGX Premium Board Index inched up by +0.25% while the NGX Insurance Index dipped by -0.71% to top all sector indices otherwise.

Gote index dipped by 0.03% to close at 143.22 basis points while Toni index closed green with +0.62% gain recorded to close at 112.03 basis points.

At the close of trading, market recorded 11 gainers to 18 losers and 74 unchanged. CHAMPION topped the list of gainers LIVESTOCK topped the list of losers. Thus, market breadth closed negative as the Market Breadth Index (MBI) is put at -0.09x.

NGX Snapshot

Sectoral Indices

Gainers

Losers

Volume and Value Contribution

OANDO led the volume chart with 12.38% contribution and closely followed by LINKASSURE and TRANSCORP.

Source: NGX, Proshare Research

MTNN led the value chart with 13.40% contribution and closely followed by SEPLAT and ZENITHBANK

Source: NGX, Proshare Research

NGX Earnings Summary

PZ Plc today filed its financial statement on the floor of the Exchange.

NGX Corporate News

No Corporate News was released on the NGX Exchange today.

1.2 NASD OTC Exchange – Unlisted Equities

The NASD market index inched up by 0.42% to close at 768.27 basis points as against 0.24% loss recorded previously.

The total volume traded advanced by +251.66% to close at 323,519 units valued at N8.91m and traded in 11 deals.

At the close of trading, NASD OTC market recorded 2 gainer(s) to 0 loser(s)

Snapshot

Gainers

Losers

Nil

Volume and Value Contribution

SDCSCSPLC led the volume chart with 92.73% contribution

SDCSCSPLC led the value chart with 49.84% contribution

NASD Earnings Summary

No Financial statement was released on the NASD OTC Exchange today.

NASD Corporate News

No Corporate News was released on the NASD OTC Exchange today.

1.3 Global Indices

On the global scene, the France CAC 40 Index leads the top five gainers with 2.81% gain while the Austria ATX tops the top five losers with -1.01% loss as of 4pm Nigerian Time

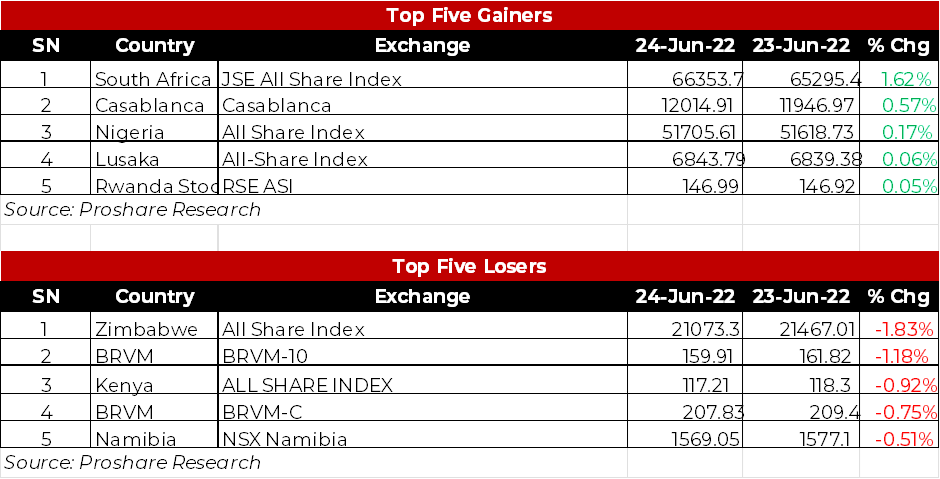

1.4 African Indices

Similarly on the African scene, the South Africa ASI Index tops the top five gainers with 1.62% gain while the Zimbabwe Index tops the top five losers with -1.83% loss as of 4pm Nigerian Time

2.1 Debt Market Size

The FMDQ Debt Market Size closed flat at N28.08trn.

2.2 Overnight and Open Repo (OPR)

The overnight lending rate closed flat at 14.00% while the Open Repo (OPR) rate also expanded by 0.17% to close at 14.00%

3.1 AFEX Indices

The ACI closed flat at 478.16 basis points as against previous figure of 478.16 while the AEI closed flat at 191.58 basis points as against previous figure of 191.58 basis points.

3.2 AFEX Commodity Prices

Paddy Rice grew by 0.59% to top the gainers’ chart while Sorghum declined by 6.86% to top the losers’ chart.

3.3 Global Commodity Prices

Gold recorded 0.12% gain while Silver also advanced by 0.57% as of 13:11 NY time

In the energy market, Brent advanced by 5.77% while WTI also advanced by 2.62% as of 12:13PM Central Daylight Time (CDT)

Source: Proshare Research, Oilprice.com, Goldprice.org

The naira appreciated by 0.01% at the I&E FX Window to close at N420.13/USD while the NAFEX rate depreciated by 0.10% to close at N419.17.

Source: FMDQ, BDC

Lagos, NG • GMT +1

Lagos, NG • GMT +1

841 views

841 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us