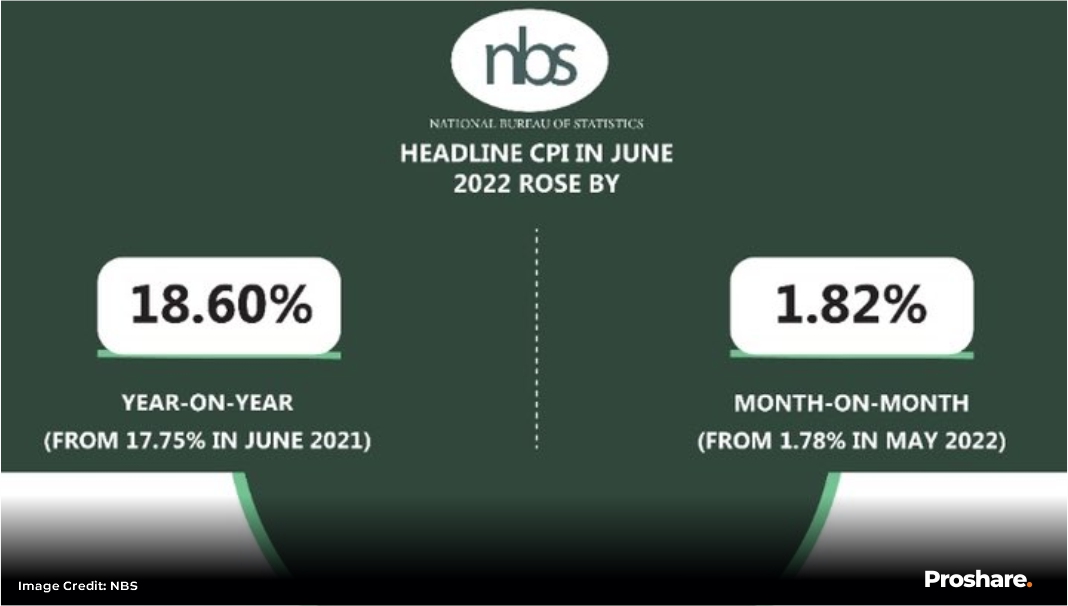

Nigeria’s Inflation rose by 88bp in June to settle at 18.6% Y-o-Y, up from +17.71% in May 2022, the new CPI numbers were released by the National Bureau of Statistics (NBS) on Friday 15 July 2022.

The inflation print has drawn several reactions from analysts. The last time Nigeria’s inflation was this high was in January 2017, when inflation rose to 18.72%. Analysts had given an 18.37% year-on-year (Y-o-Y) forecast for headline inflation as early shopping in preparation for the recently concluded Eid celebration was expected to push food prices up and drive overall inflation. However, compared to May 2022 general prices picked by 1.8% in June.

The Y-o-Y food sub-index rose +20.6% in June 2022, the highest since last August, while the average food price rose 2.05% compared to May. Core inflation of +15.75% came in at a five-year high, signalling higher long-term inflation. A combination of factors including the global and domestic energy crisis, the recently implemented N10/litre excise duty on beverages, weakening Naira, domestic scarcity of fuel, and transportation costs contributed to the historically high inflation rate in June.

Nigerians have had to endure consistent rent hikes by landlords, a situation that has left the average household with weaker purchasing power. A look at the Inflation figures shows that apart from Food and Energy, Housing, Electricity, and Transport recorded the highest inflation rates in June (see Illustration 1 below).

Illustration 1: Drivers of Inflation (Y-o-Y ) Inflation June & May

The Subnational Inflation Bogey

Meanwhile, Kogi State recorded the highest inflation as the state’s bespoke index grew by 21.37%. Food Inflation was highest in Kwara State (25.62%). Bauchi, Ebonyi, and Rivers states recorded the highest inflation rates of around 20% in June.

The latest inflation figure brings Nigeria’s inflation for H1 2022 to +16.72%. Over the corresponding period in 2021, H1 2021, the inflation rate was +17.63%. Proshare analysts have upwardly reviewed Nigeria’s inflation outlook for FY 2022 to +19% (up from +16.98% in FY2021), given the average monthly CPI growth, while annual inflation could hit +22% by December.

With inflation rising to a 5-year high in June, the Monetary Policy Committee (MPC) is expected to hike rates by another 25bp when it meets, later, this month. This is despite Stanbic IBTC Purchase Managers Index (PMI) at 50.9 moving closer to contraction in June 2022 from 53.9 in the prior month. The decline points to weakening private sector manufacturing activity.

Headline Inflation: Staring at the Skies Unkindly

General inflation in June came in at +18.60% suggesting that the CPI rose by +18.60% in June 2022 in comparison to June 2021. The rise was higher than the +17.71% annual rate in May 2021 (see Chart 1 below).

Chart 1: Nigeria's Headline Inflation Rate (Y-O-Y) May 2021 - June 2022 (%)

On a month-on-month (M-o-M) basis, the general price level in June rose by 1.82%, the highest in months. Prices in June were on average +1.82% higher than they were in May. M-o-M inflation has over time mirrored the headline inflation rate (see Chart 2 below).

Chart 2: Nigeria's Headline Inflation Rate(M-o-M) May 2021 – June 2022 (%)

Source: NBS, Proshare Research

Food Inflation: Hunger Meets Rising Prices

The food sub-index recorded a Y-oY rise of +20.60%, suggesting that the price paid by Nigerians for food in June was on average 20.60% higher than the price paid in the corresponding period of 2021. The rise represents a 111bp increase above the +19.50% food inflation in May. The relatively faster growth in food prices in June could be associated with the recent N10/litre excise duty levied on sweetened beverages (see Chart 3 below).

Chart 3: Nigeria's Food Inflation Rate June 2021- June 2022(%)

The price of non-alcoholic beverage commodities rose by +20.5% compared to the corresponding period of 2021 reflecting the newly implemented excise duty.

On a monthly basis, food CPI data showed that food prices rose by +2.5% in June compared to the food prices in May 2021. (See Chart 4 below)

Chart 4: Nigeria's Food Inflation Rate June 2021- June 2022(%)

Core Inflation: A Knotty Non-food Problem

The prices of non-farm and energy products rose by +15.70% year-on-year in June. Data suggests that the price of items in the core subindex was 15.70% higher in June than they were in the corresponding period of 2021. The recent figure indicates that core inflation saw the swiftest rise in the sub-index since February 2017 (see Chart 5 below).

Chart 5: Nigeria's Core Inflation Rate May 2021 - June 2022 (%)

On a M-o-M basis, prices in the core sub-index rose by 1.56%, which was higher than the 1.87% rate at which prices of non-farm items rose in May 2022. Core inflation however moderated on a M-o-M basis (see Chart 6 below).

Chart 6: Nigeria's Core Inflation Rate (M-o-M) June 2021 - June 2022 (%)

Source: NBS, Proshare Research

Inflation trends in Urban and Rural Locations

In June urban inflation rose by +19.1% year-on-year, suggesting that prices in urban centres have risen, in the period under review, more than they have risen generally (18.60%). In May, urban CPI rose by +18.24%. Meanwhile, inflation data showed that prices of Food, and Transport grew fastest on a Y-o-Y basis in Urban centres. Rural inflation came in at 18.13% in June.

Last month, Bauchi, Kogi, and Ebonyi States recorded the highest overall inflation rates for states. In terms of food inflation, Kwara state recorded the fastest increase in food CPI, in the customized basket of commodities, there was a +25.62% increase in June when compared to the CPI in June last year. Kogi (+24.81%) and Rivers (+24.34%) states also saw rising food inflation last month (see Chart 8 below).

Chart 8: Headline and Food Inflation for States (%) June 2022

Inflation trends Abroad; Babarians at the Gate?

US Inflation for June came in at 9.1% a 41-year high, with energy prices and Aviation fares being the major factors responsible for the record CPI growth. Analysts are of the view that this would give the FOMC reasons to undertake an unprecedented 100bp hike in rates. After a 75bp hike in rates last month, the benchmark policy rate currently hovers between 1.5% and 1.75%.

With the base rate in the US expected to rise to between 3.75% and 4% by the year-end the appreciation in the dollar against the Euro and other major currencies may be sustained. Meanwhile, experts believe that a 100bp rate hike could stifle emerging markets of the capital. Meanwhile, it is looking more likely that a ‘hard-landing’ as against a ‘soft-landing’ is more likely with the proposed rate hike stoking fears of a recession in the world’s largest economy.

In the Euro area, inflation has worsened from 5.1% in January to 8.6% in June reflecting rising energy which grew Y-O-Y by close to 40% in May. The ECB has announced its readiness to curtail raging inflation by raising rates by at least 25bp twice this year.

UK Inflation expectedly worsened in June, the world’s fifth largest economy recorded 9.1% inflation in May up from 5.5%, the Bank of England MPC encouraged by the 0.5% GDP growth recorded in May is expected to deliver another 25bp hike in rates next Thursday (see Chart 9 below).

Chart 9: Global Inflation (%) May/June 2022

End Note: Inflation Outlook

Despite the Russian-Ukraine tension, Crude oil prices have eased to below US$100/b on the back of a lower global crude oil demand forecast. The spike in Covid-19 cases in China and India seems to put downward pressure on the price of crude oil. Meanwhile, bumper harvests of Wheat, Soybeans and Corn have also forced a reduction in commodities’ prices. Analysts would continue to monitor the situation in China and India to gain a sense of direction of crude oil prices while it seems prices of grains may continue to moderate in the near term (see Chart 10 below).

Chart 10: Crude Oil, Wheat, and Corn (%) June 2022

Lagos, NG • GMT +1

Lagos, NG • GMT +1

778 views

778 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us