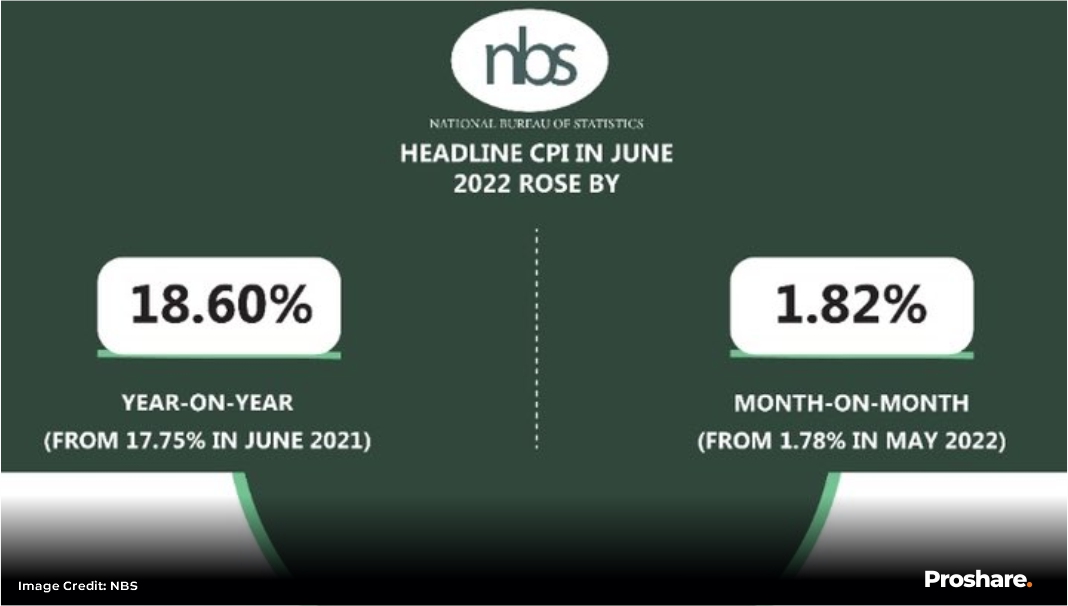

The NBS is scheduled to release its July CPI report on August 15. Based on our survey of major markets in Lagos Metropolis and econometric model, headline inflation, which measures the annual change in the general price level, is estimated to rise again to 19.7% from 18.6% in June. If our projection is correct, it will be the 6th consecutive monthly increase and the highest inflation rate since 2006. Month-on-month inflation, which measures current price movements, is also expected to follow a similar trend, rising by 0.02% to 1.84% (24.52% annualized).

Nigerian inflation increasing despite declining global food price index

Like most other economies, spiralling inflation in Nigeria have been largely attributed to the spike in global food and energy prices. Most commodities traded at record highs as a result of the Russian-Ukraine war-induced supply disruptions. For African countries, the effect was compounded by currency pressures as most advanced economies adopted tighter monetary policy stance to contain inflation.

However, global food prices are beginning to taper but inflation in Nigeria and other African countries have remained sticky downwards. The FAO global food price index fell sharply by 8.6% to 140.9points in July, the 4th consecutive decline. All sub-indices declined especially vegetable oils and cereals, which benefitted from the Russian-Ukraine deal to resume grain exports from Black Sea ports.

Currency depreciation muting the impact of declining global food prices

The divergence between domestic inflation and global prices is partly because of the time lag between exogenous events and transmission into domestic prices. Imported inflation is a combination of high global prices and exchange rate depreciation. Even though we have begun to see global food prices declining, the impact may be limited in Nigeria by a further deterioration in the value of the naira. Based on our econometric model, exchange rate has had a 76% impact on the price level.

Of the 8 African countries that have released their July inflation figures, 7 recorded increases while only Ethiopia posted a decline. This trend is likely to continue, posing significant threats to food security and could possibly worsen the continent’s socio-economic conditions.

Money supply saturation also fueling inflation

One of the major factors fuelling inflation and currency pressures is the continued spike in money supply without a corresponding increase in output or foreign exchange earnings. The CBN has remained committed to providing development finance in a bid to support economic recovery. While this is a step in the right direction, inability to channel the intervention funds towards productive activities would be inflationary. This will be further compounded by the FG’s ways and means advances, which is currently at N19.9trn.

Recession fears likely to pose significant threat to food security

While the decline in the global food index is good news for consumers and other economic agents, high fertilizer prices suggests that agric production could be affected in the coming months. This coupled with weak global economic outlook and currency pressures pose significant constraints for global and domestic food security. Based on our model, Nigerian food inflation is projected to rise to 22.3% in July from 20.6% in June.

Concluding Thoughts

Nigerian inflation is likely to continue its upward trend in the coming months, albeit increasing at a slower pace. Currency pressures will continue to mute the impact of falling global food prices. The good news is that the harvest is expected to commence at the end of Q3. This will boost supply and taper domestic food prices.

Lagos, NG • GMT +1

Lagos, NG • GMT +1

318 views

318 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us