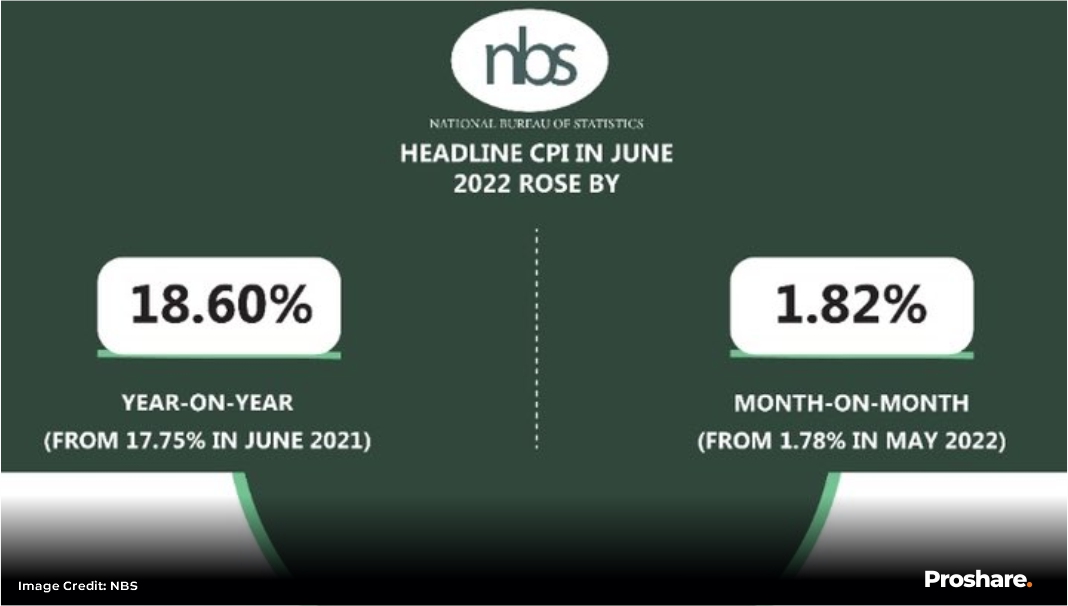

The CPI report for the month of July was released today by the NBS. Nigeria’s headline inflation rose by 1.04% to 19.64% from 18.6% in June. This is the 6th consecutive monthly increase and the highest inflation rate since September 2005. Food inflation, the major victim of supply chain disruptions spiked to 22.02%. This may not be surprising because June is the peak of the planting season. Core inflation, which is inflation less seasonality's, also increased by 0.51% to 16.26%.

This spike in inflation is happening at the same time as we have seen a surge in inflation in Ghana and Rwanda where inflation increased to 31.7% and 19.6% respectively. Despite the reduction in global food prices, persistent currency pressures in most African countries have kept domestic prices elevated. The FAO food price index declined for the 4th consecutive month to 140.9 points in July.

Is Global Inflation at a Tipping Point?

The report that the US inflation had slowed from 9.1% to 8.5% at a time when expectations were for further elevation in inflation has helped to douse fears of an ever increasing bout of spiraling inflation. In the US, the price of gasoline has fallen by over 20% from $5 to $4 per gallon. As the world’s largest economy (25% of GDP), any signal of falling inflation could mean a tipping point for the better for the global picture on inflation. Nigeria and other African economies are also likely to record lower consumer prices in the coming months.

However, imported inflation is not only affected by global price movement but also currency volatilities. Persistent currency pressures in most African economies would continue to limit the impact of lower global commodity prices.

In addition, the gradual decline in global inflation reduces the probability of a further hike in interest rates in advanced economies. This will bode well for the global economic growth, which has suffered significant slowdown especially in the last two quarters.

Inflation Breakdown

Monthly inflation flats at 1.817%

Month-on-month inflation (a more current measure of prices) was flat at 1.82% in July. This partly reflects the impact of the harvest season, which typically commences at the beginning of the 3rd quarter.

Food inflation rises by 1.42 % to 22.02%

Despite the decline in global food prices, the annual food composite price index climbed by 1.42% to 22.02% in July. This largely reflects exchange rate pass-through effect on domestic prices combined with the knock on effect of higher diesel prices on logistics and distribution costs. Meanwhile, the monthly food index was relatively flat at 2.04% (compared to 2.05% in June). The commodities that recorded the highest price increases are bread and cereals, potatoes, yam and other tubers, meat, fish, oil, and fat.

Core inflation climbs 0.51% to 16.26%

Both the annual and monthly core inflation sub-indices increased in July. The annual sub-index was up0.51% to 16.26% while the monthly sub[1]index rose by 0.19% to 1.75%. This was largely due to currency depreciation and higher energy prices. The Naira lost 15.5% in the last one month. The commodities that recorded the highest prices increases include gas, liquid fuel, solid fuel, road& air transport, garments, cleaning, repair and hire of clothing.

Urban-Rural inflation both increased

There was an increase in inflation across the urban and rural sub-indices in July. Urban inflation rose by 1.0% to 20.09% (y-o-y), while it remained flat at 1.82% (compared to 1.82% in June) on a monthly basis. Also, the annual rural sub-index increased by 1.09% to 19.22% while the monthly sub-index was unchanged at 1.81%) The urban[1]rural differential fell to 0.87% from 0.96% June.

State-by-state analysis

Akwa-Ibom recorded the highest inflation rate in July (22.88%), followed by Ebonyi (22.517%) and Kogi (22.08%). The states with the lowest inflation rates are predominantly in the North: Jigawa (16.62%), Kaduna (17.04%) and Borno(18.04%). These states are benefiting from the harvest.

Sub-Saharan Africa: Inflation continues to spiral

Inflation in Sub-Saharan Africa (SSA) is more to the upside. Five out of the six SSA countries under our review that have released their inflation numbers for July recorded increases while only one recorded a decline. Persistent currency pressures continue to limit the impact of lower global commodity prices. Three of the SSA countries under our review increased interest rates at their last meetings.

Inflation and Monetary Policy Rates in Key African Countries

Rising Inflation – Policy Impact

Nigerian inflation is likely to continue its upward trend in the coming months, albeit at a slower pace. Currency pressures will continue to mute the impact of falling global food prices. The good news is that the harvest is expected to commence at the end of Q3. This will boost supply and taper domestic food prices. Notwithstanding the rise in inflation, the MPC is unlikely to increase the monetary policy rate in September. This is to give more room for the previous rate hikes to permeate the market

Lagos, NG • GMT +1

Lagos, NG • GMT +1

320 views

320 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us