Guaranty Trust Holdings Plc released its Q2 2022 Audited results for the period ended June 30th, 2022.

Key Highlights

- Gross Earnings grew by 15.1% from N207.91bn to N239.29bn.

- Profit before tax stood at N103.25bn

- Profit after tax stood at N77.56bn

- Share Price Currently Stands at N19.8k

- Proposed Dividend is 30 kobo per 50 kobo ordinary share

Guaranty Trust Holding Company Plc (“GTCO” or the “Group”) has released its Audited Consolidated and Separate Financial Statements for the period ended June 30, 2022, to the Nigerian Exchange Group (NGX) and London Stock Exchange (LSE).

The Group reported profit before tax of ₦103.2billion, representing an increase of 11.0% over ₦93.1billion recorded in the corresponding period ended June 2021. The Group’s loan book (net) increased by 1.8% from ₦1.80trillion recorded as at December 2021 to ₦1.83trillion in June 2022 while deposit liabilities increased by 6.4% from ₦4.13trillion in December 2021 to ₦4.39trillion in June 2022.

The Group’s balance sheet remained well structured and resilient with total assets and shareholders’ funds closing at ₦5.7trillion and ₦845.7billion, respectively. Full Impact Capital Adequacy Ratio (CAR) stayed very strong, closing at 22.0%, while asset quality was sustained as IFRS 9 Stage 3 Loans ratio and Cost of Risk (COR) closed at 6.2% and 0.2% in June 2022 from 6.0% and 0.5% in December 2021, respectively.

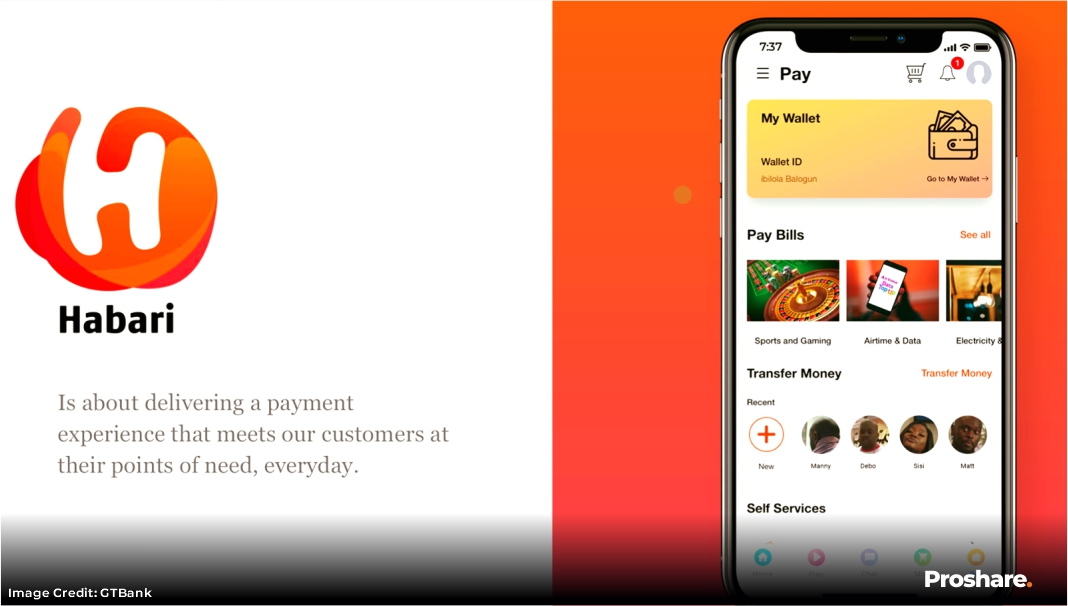

Commenting on the results, the Group Chief Executive Officer of Guaranty Trust Holding Company Plc (GTCO Plc), Mr. Segun Agbaje, said; “Our results show an increase in key revenue lines and a strong performance in other financial metrics which reinforce our growth prospects as a leading financial services company. Our priority at the start of the 2022 financial year was to bring the Group’s new businesses on-stream, starting strong with a focus on long-term viability. At present, we have successfully expanded our financial services ecosystem to include HabariPay Ltd, Guaranty Trust Fund Managers Ltd, and Guaranty Trust Pension Managers Ltd, and all of them are P&L positive.”

He further stated that, “These newly created businesses will operate alongside our flagship banking franchise to offer increased value to our growing customer base as well as other stakeholders. We will continue to build on our core strengths of service excellence, innovation, and flawless execution to deliver our corporate objectives for the year and further our vision of being Africa’s leading financial services institution.”

Overall, the Group continues to post one of the best metrics in the Nigerian Financial Services industry in terms of key financial ratios i.e., Pre-Tax Return on Equity (ROAE) of 23.9%, Pre-Tax Return on Assets (ROAA) of 3.7%, Full Impact Capital Adequacy Ratio (CAR) of 22.0% and Cost to Income ratio of 49.1%.

Visit Guaranty Trust Holdings Plc IR Page in Proshare MARKETS

Lagos, NG • GMT +1

Lagos, NG • GMT +1

965 views

965 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us