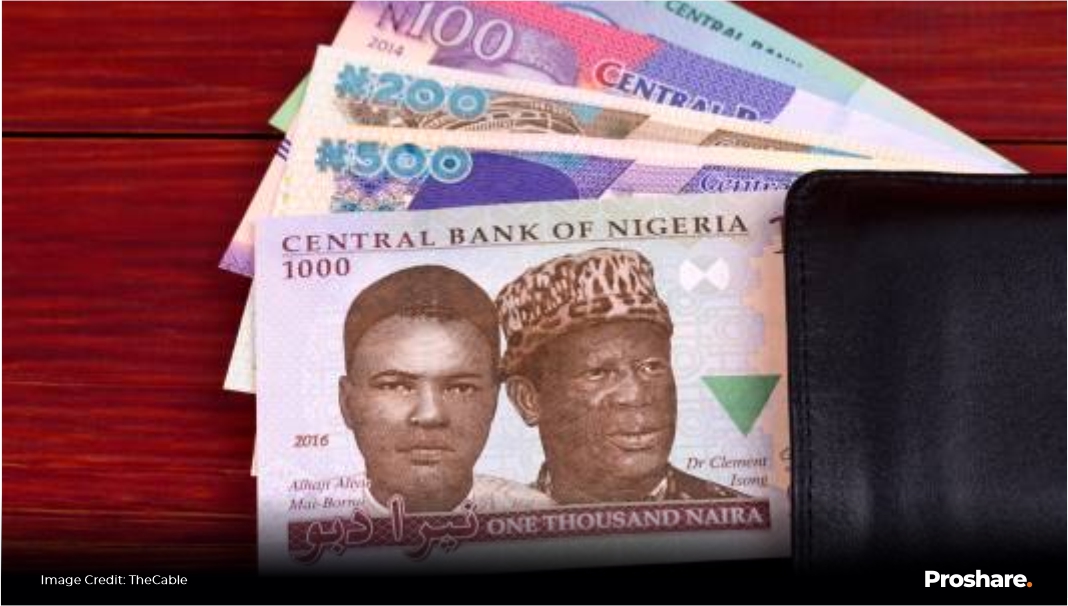

The Central Bank of Nigeria (CBN) in a recent press release noted that there has been positive response from the public to the naira redesign agenda through increased currency deposits across banks and other financial institutions. The CBN reiterated its commitment to the seamless implementation of the initiative to ensure the achievement of its objectives of reducing the significant amount of cash outside the banking system and its use in criminal activities, curtailing counterfeiting, and promoting financial inclusion, amongst others. It further noted that in operationalizing the initiative, the CBN has been collaborating with relevant agencies and other stakeholders in the financial system in its execution, particularly ensuring that vulnerable citizens are not disenfranchised.

Accordingly, agent locations across the country have been fully enabled for BVN registration, bank accounts/wallets & e-Naira wallets opening, electronic card distribution, and cash deposit, among others. The agents have also been given priority to deposit cash collections in bank branches across the federation.

Meanwhile, Money Supply statistics from the CBN as of September 2022 showed that currency in circulation increased month-on-month by 0.56% to N3.23trn as of September 2022 from N3.21trn as of August 2022. Similarly, currency outside banks increased month[1]on-month by 1.85% to N2.73trn (representing 84.53% of currency in circulation) as of September 2022 from N2.68trn (representing 83.48% of Currency in Circulation) in August 2022. We note particularly that currency outside the banks has averaged c.84.42% of currency in circulation since the year 1960; the lowest being 72% in May 2008 and highest being 94.78% in March 1995.

Apparently, the challenge of having a high proportion of currency in circulation outside the banking system has remained since independence despite previous currency redesigns and printing. We hope that this current policy will cause an enduring reduction in the volume of currency outside the banking system. However, Broad Money (M2) remained steady at N49.32trn as of September 2022, same value as of August 2022 but increased by 9.38%, year-to-date, from N45.09trn as of January 2022.

Lagos, NG • GMT +1

Lagos, NG • GMT +1

312 views

312 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us