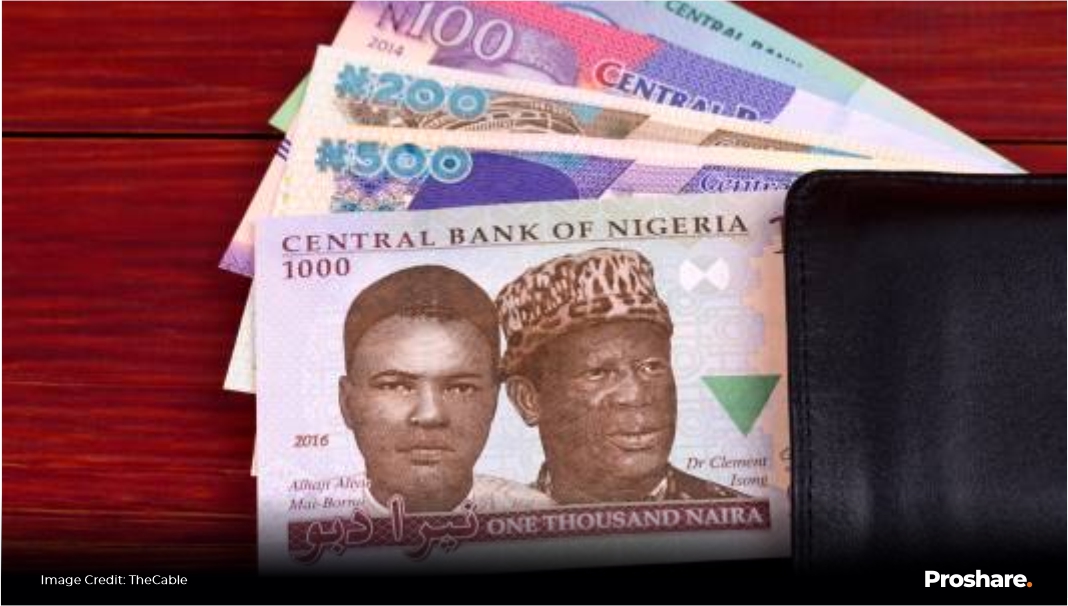

Last week the Central Bank of Nigeria announced the plan to redesign the N200, N500, and N1,000 notes. At a press briefing, the CBN Governor, Mr. Godwin Emefiele, said the new design and issues would be effective from December 15th, 2022.

The decision, according to him, was based on the need to take control of the currency in circulation in the country. Data from the CBN showed that N2.73 trillion out of the N3.23 trillion currency in circulation is outside the vaults of commercial banks across the country.

This policy step comes at a critical time. The nation is grappling with rising inflation, the impact of currency devaluation and foreign exchange market instability, insecurity across the nation and the recent ravaging floods that have displaced hundreds of thousands of Nigerians.

Four areas of debate and concerns have been raised since the CBN took the decision.

Timing and Additional Shocks for Households

While the Central Bank of Nigeria is within its purview to redesign currency notes and, in this context, long overdue, the policy's first debate is timing. Some economists and trade groups like the Lagos Chamber of Commerce and Industry and the Centre for the Promotion of Private Enterprise, CPPE, believe the is ill-timed, a sheer waste of resources and not a key priority at this point. They are concerned that this will add shocks to households already grappling with rising food inflation, currency devaluation and diminishing purchasing power parity.

They also suggest that the CBN revisit the decision and consider converting currency noted from N1,000 below to coins.

The Gap in Fiscal and Monetary Policy Alignment

The Second debatable issue is the alignment of fiscal and monetary policies. The Finance Minister, Mrs. Zainab Ahmed, said the decision taken by the CBN was made without carrying the fiscal policy authorities along. Dr. Ayo Teriba, an economist in a recent "Arise TV" interview, highlighted that the Ministry is a major stakeholder in the activities of the CBN.

He stressed that in developed economies, the Finance Ministry or Treasury Department is carried along in decisions of the Central Bank.

According to him, any step taken by the CBN without working in tandem with the Fiscal authorities is a recipe for chaos.

President Muhammadu Buhari, GCFR, in an interview on a BBC Hausa programme, backed the CBN Governor, saying the decision will tackle financial crimes, illicit financial flows and clampdown on corrupt practices.

Weakening Currency

The third debate is the implications for the foreign exchange market, as the decision to redesign the currency notes has a signaling effect on the market. Will it weaken or strengthen the Naira currency?

Currently, the naira currency is weakening, and there are concerns that it could go as high as N800 to a dollar at the parallel market, creating additional dislocation for businesses and pressure for households.

IMF's Call for Caution

The International Monetary Fund through its Resident Representative in Nigeria, Ari Aisien, in his statement on the policy announcement, advised the CBN to be cautious to avoid any missteps that could undermine confidence in the financial system.

This decision will have broad implications for the following:

1. Domestic and foreign investments into the economy

2. Inflation

3. Currency circulation

4. Business Operations

5. Financial system stability

6. Anti-Money Laundering

7. Activities in the Retail Sector

WATCH VIDEO

Lagos, NG • GMT +1

Lagos, NG • GMT +1

554 views

554 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us