Friday, July 12, 2019 /09:40AM / By FBNQuest Research / Header Image Credit: FBNQuestResearch

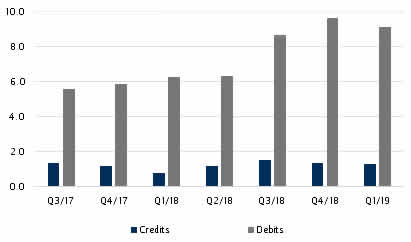

Along with the fall in oil and gas exports and therise in non-oil imports, one reason why the current account returned to deficitin Q1 2019 was the continuing deterioration on the services account (GoodMorning Nigeria, 04 July 2019).The net deficit on services has widened to 7.5% of GDP from 5.9% one yearearlier and only 1.7% in Q1 2017. Now that fx is freely available, debits onthe travel segment of services have soared to US$3.63bn from US$1.48bn in Q12018 and US$490m in Q1 2017.

Of the total for traveldebits, education-related expenses were US$1.66bn, health US$680m and businessUS$420m. This tells us that the Nigerian business climate is subdued, and thatNigeria pays a high price for the shortcomings of its education and healthsectors.

Debits for other businessservices amounted to US$3.72bn in Q1, compared with US$2.49bn in theyear-period. This is another reflection of the transformed availability of fxsince the CBN’s reforms. Technical and trade- related payments accounted forUS$3.16bn.

Credits on the services accountin Q1 2019 amounted to just US$1.33bn, of which travel and transportationaccounted for US$1.05bn. In the short term we do not see a dramatic increase inthese credits. It would take time to replicate, for example, the tourismindustry in Kenya and Egypt, or the outsourcing and IT hub in India.

| Transactions on the services account (US$ bn) |

|

|

| Sources: CBN; FBNQuest Capital Research |

This brings us back to thepivotal oil and gas industry if Nigeria is to post a regular current-accountsurplus. The crude price is beyond the FGN’s influence obviously but thepassage of an industry bill with a new operating and fiscal framework couldkick-start investment in existing and new acreage. Non-oil exports can play asupporting role.

Related News

- NESG Unveils New Brand Identity, Highlights Achievements Since 1993

- FAAC Disburses N616.20bn in May 2019 - NBS

- Headline Inflation For June To Increase Marginally To 11.42%; M-o-M On A Steep Rise

- Weekly Economic and Financial Commentary – WE 05 July, 2019

- PAC Holdings leads Green Finance Campaign for Sustainable Environmental Projects

- Nigeria and The Excess Supply of Intellectual Dishonesty – LBS Exec. Breakfast Session – July 2019

- Nigeria’s Current Account Into Deficit in Q1 2019

- NIPOST Generates N7.05bn As Revenue in 2018 - NBS

- Total Value of Capital Importation into Nigeria Stood at $8,485.49m in Q1 2019

- Weekly Economic and Financial Commentary – WE 28th June, 2019

- Manufacturing PMI Stands at 57.4% in June 2019 from 57.8% in May 2019

- N2trn Realized From Sale of State Enterprises Since 1999 - BPE

- Nigeria Scores Low On Development Indices

- All Commodity Group Export Price Index Rose By 1.85% In Q1 2019

- Nigeria Needs More Reciprocal External Trades

- Key Takeaways From Inauguration of NEC Team (2019-2023)

- Weekly Economic and Financial Commentary – Week Ended, June 21, 2019

- Headline Inflation Increases By 11.40% YoY in May 2019; 0.03% Higher Than April 2019 Rate

- Weekly Economic and Financial Commentary – WE 14th June, 2019

- CIBN, Others To Examine Critical Issues That Will Improve The State Of Infrastructure In Nigeria

Lagos, NG • GMT +1

Lagos, NG • GMT +1

2137 views

2137 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us